In his recent book, The Third Wave: An Entrepreneur’s Vision of the Future, Steve Case, investor, entrepreneur, and founder of AOL outlines three waves of the Internet. The first wave of the Internet was all about building the foundation of the Internet, like AOL, Netscape, Cisco, IBM, etc. The second wave built on the foundation of the first wave, building the app economy and mobile revolution. It has been dominated by search, social, and ecommerce startups growing on top of the Internet. Examples include Amazon, Google, Facebook, Snapchat, and Twitter.

According to Case, the Third Wave of the Internet will bring technological innovations beyond the web and mobile worlds of the first and second waves, directly to the real world, to industry verticals, sectors, and sub-sectors where cities other than traditional startup hubs like Silicon Valley have strengths they can leverage to grow their economies. As the tech world transitions into the Third Wave of the Internet, new opportunities will emerge for smaller startup ecosystems like Sacramento.

The 2018 Global Startup Ecosystem Report (GSER), a collaboration between Startup Genome and the Global Entrepreneurship Network (GEN), was recently released. New to this year’s report, the authors covered fundamental shifts in technology industries, and sub-sectors, including what they refer to as, the ‘New Era of Tech: Third Wave and Deep Tech.’

“We see this rise of Third Wave and Deep Tech clearly in the data for sub-sector growth. The fastest growing sub-sectors all fit these categories of Third Wave and Deep Tech…”

Their findings show that cities with existing strengths that match the fastest growing sub-sectors have an opportunity to build a new economy on the foundation of those strengths.

“In this new era of tech, one strategy for smaller ecosystems to increase their footprint is to focus on specific sub-sectors in either verticals or deep tech areas where they have existing strengths. Only a few ecosystems can be the top-performer in the world across the board, but many smaller ecosystems have the potential to become a top cluster for specific sub-sectors.”

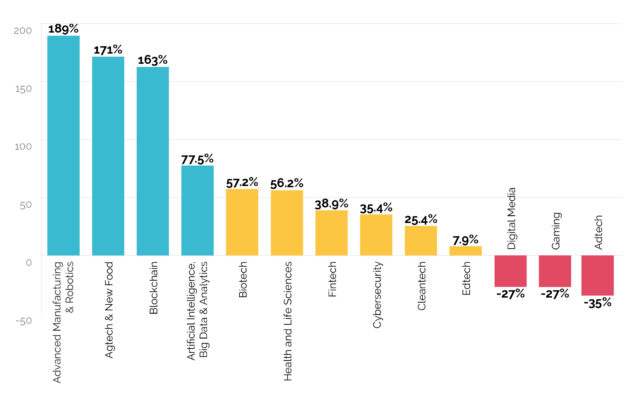

In analyzing technology industries and sub-sectors, GSER identified growing, mature, and declining sub-sectors using performance variables such as; Early Stage Deals 5-Year Growth, Exits 5-Year Growth, Share of Global Startups, and Startup Formations Growth.

Growing Industry Sub-sectors

The top growing verticals with expected 5-year increase in early stage funding deals include:

- Advanced Manufacturing and robotics – 189% increase

- AgTech and New Food – 171% increase

- Blockchain – 163% increase

- AI, Big Data and Analytics – 77.5% increase

Mature Industry Sub-sectors

Mature sub-sector verticals with expected 5-year increase in early stage funding deals include:

- Biotech – 57.2% increase

- Health and Life Sciences – 56.2% increase

- Fintech – 38.9% increase

- Cybersecurity – 35.4% increase

- Cleantech – 25.4% increase

- Edtech – 7.9% increase

Declining Industry Sub-sectors

Declining sectors for early stage funding deals include:

- AdTech – 35% decline

- Gaming – 27% decline

- Digital Media – 27% decline

These are summarized in the chart below.

Sacramento region’s tech strengths? The analysis of the Sacramento region’s tech strengths has been addressed many times over recent years with several initiatives and organizations involved in identifying our core strengths.

Next Economy Report

Those who have been in Sacramento for more than a few years will remember the five-year economic diversification plan called Next Economy, unveiled in 2013. The Next Economy project identified “seven viable clusters in the Sacramento Region based on economic performance, innovation activity, and other relevant dynamics.”

- Advanced Manufacturing

- Agriculture & Food

- Clean Energy Technology

- Education & Knowledge Creation

- Information & Communications Technology

- Knowledge-Intensive Business & Financial Services

- Life Sciences & Health Services

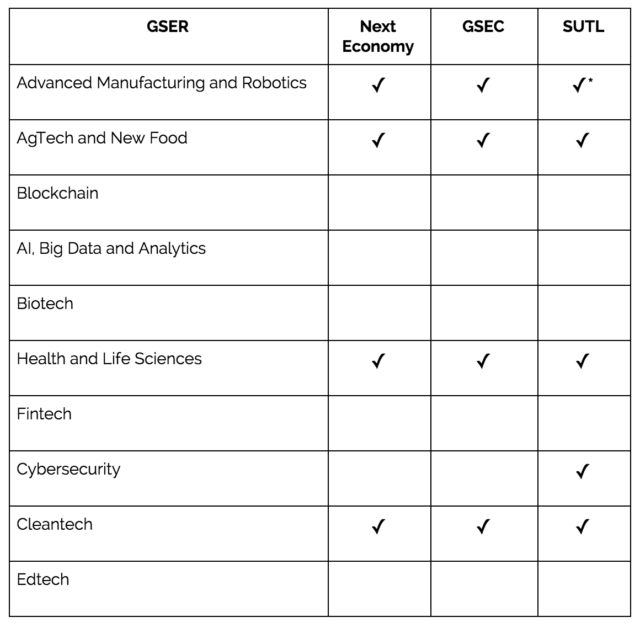

Four of those seven, Advanced Manufacturing, Agriculture & Food, Clean Energy Technology, and Life Sciences & Health Services correspond to growing or mature sub-sectors identified in GSER.

Greater Sacramento Economic Council

Currently, the leading regional economic development organization is the Greater Sacramento Economic Council (GSEC). On their website GSEC identifies a set of core industries for the Sacramento region.

- Agricultural Technology

- Advanced Manufacturing

- Life Sciences

- Biotechnology

- Clean Energy Technology

- International Business

- Education & Knowledge Creation

- Advanced Technology

- Startups

Interestingly, the same four sub-sectors that Next Economy aligned with GSER are also part of GSEC’s core industries.

City of Sacramento’s Sacramento Urban Technology Lab

In November last year, the City of Sacramento launched the vision of the Sacramento Urban Technology Lab (SUTL). SUTL, identifies seven core verticals for its focus:

- Mobility

- Clean Technology and Sustainability

- Health IT and Life Sciences

- Food Systems

- Internet of Things (IoT) and Cybersecurity

- Government and Civic Technology

- Workforce Development

Of this set, several again match growing or mature verticals identified by GSER; Clean Technology and Sustainability, Health IT and Life Sciences, Food Systems, & Cybersecurity. It’s also worth noting that the GSER includes IIOT (Industrial Internet of Things) in its deep dive of Advanced Manufacturing.

Comparing GSER’s identified sub-sectors to what Next Economy, GSEC, and City of Sacramento, we can see there are several matches, as shown in the chart below.

*GSER includes IoT, specifically IIoT, in its detailed analysis of Advanced Manufacturing and Robotics.

So, we have an exhaustive report that identifies opportune sub-sectors for smaller startup ecosystems like Sacramento to focus on. We have a set of our region’s strengths or focus areas that business and civic leaders have identified that align well with several growth or mature sub-sectors. What’s the takeaway for Sacramento startups and startup enablers?

Overall I think it’s good news that many industry verticals that our business and civic leaders have identified correspond to mature or growth sectors. If we focus our efforts on strengthening and leveraging those areas, Sacramento has the potential to become a top player in those areas. There are additional key insights for ecosystem builders in the GSER that can be beneficial to startup enablers and startups as well. Diving down into the details of each these sub-sector analyses in the GSER report is warranted, but I’ll follow up with those in subsequent articles. For now, if you’re a founder of a startup or a startup enabler in one of these verticals, check out the deep dive of the sub-sector in the GSER.

I’ll close with a challenge. Those of us who are Sacramento startup ecosystem builders need to come together to get us on GSER’s radar and participate in their next round of surveys to get Sacramento included. Who’s with me?

I am with you!

Me too!