Many early stage startups look to venture capital to raise money. But founder beware! There is a lot to know before you jump into the venture capital investment game. Security types, SEC rules, term sheets, what to expect from due diligence, and more. It’s a lot.

At February’s StartupSac Office Hours, attorney Jan Roos gave an overview of investment essentials for startup founders and provided a better understanding of the consequences and obligations of accepting investment capital. Check out the video below. Download the presentation slides here.

Topics Included:

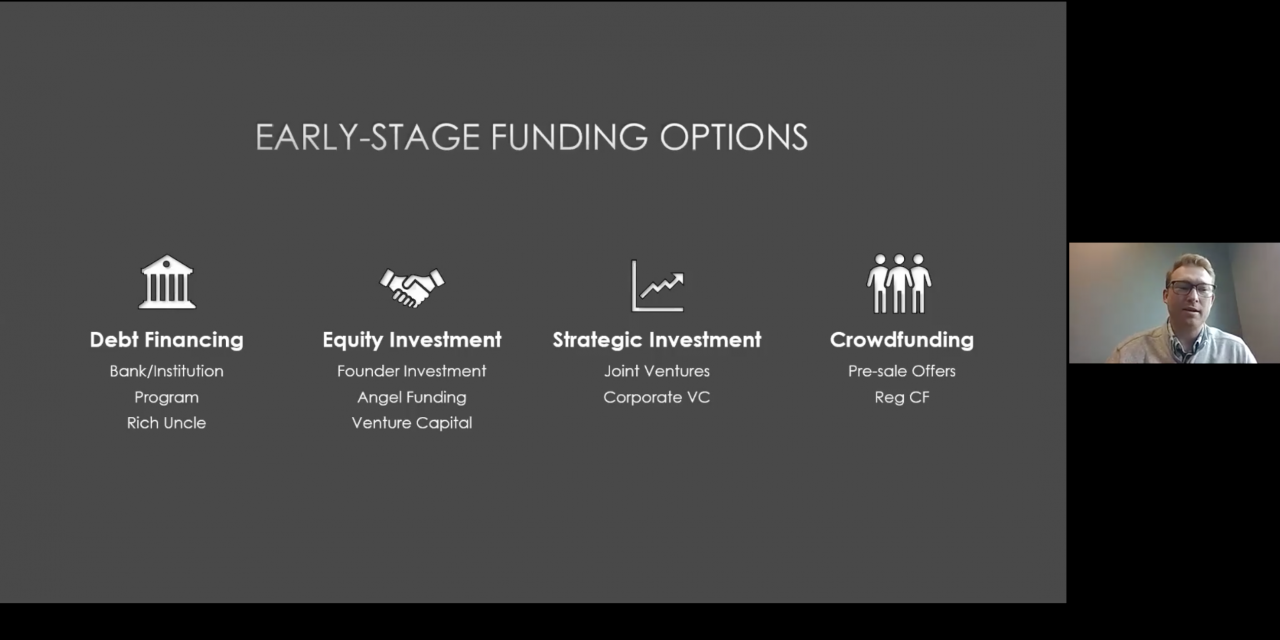

- Types of Funding

- Securities Transactions

- Reading Term Sheets

- Surviving Due Diligence

- Living with Investors

About Jan Roos

Founder of Outside.Legal, Former Partner, Witan Law

Jan Roos’ background in commercial transactions and complex litigation gives him a unique perspective on how companies can organize in the present and plan for the future. Designing a custom growth strategy is essential for each business, but knowing how to protect your assets and ideas is equally important. Jan’s years of advisory experience for startups and high-growth companies allow him to accurately assess legal needs and design effective strategies for positive prescription and resolution. Jan serves founders and companies in multiple industry sectors including software, finance, transportation, energy, retail, and more. His penchant for creative legal analysis, effective advocacy, and attention to detail result in successful outcomes for clients across the spectrum.

ABOUT WITAN LAW

Our team is comprised of legal specialists who can be individually deployed for single-instance projects or combine for comprehensive legal strategies. We focus on the growth of your business and build in essential compliance considerations to establish confidence among co-founders, investors, employees and your customers. Our success is derived from yours, and our commitment to client development is second to none. Learn more at witan.law.