The following is a guest post by StartupSac sponsor Alex Chompff of Chompff Consulting

It’s an exciting time to be in the startup world. Blockchain investments in 2018 are analogous to .coms in 1997, which is to say that smart friends have heard of blockchain, but they still don’t know what an ICO is. For smart contracts, it’s like 1995.

Early in any new technology cycle (and it is early in the blockchain refactoring), opportunities for

investment are too plentiful to list and their numbers increase geometrically. It will take 20 years to mature blockchain technologies, just as .coms have coalesced around a few major players since the heady days of the 1990s.

Right now, long term value investors are thinking about infrastructure – roads and gas stations rather than the contents of individual cars and trucks.

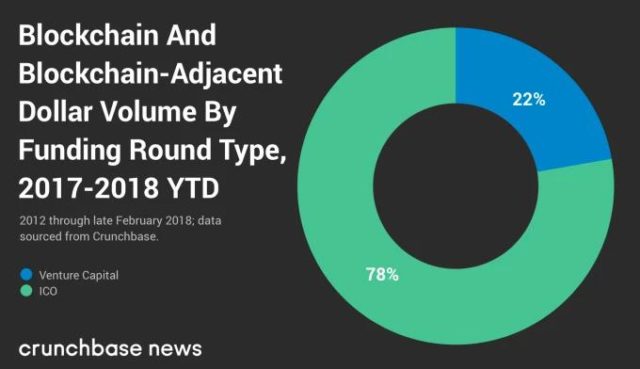

Waves of blockchain capitalization are changing the funding dynamics of the startup world. The inflow of non-professional capital into startups through the vehicle of token/coin offerings has surpassed the total volume of Angel and VC investment globally for several months running.

From the Wall Street Journal, August 2017:

“This year, more capital was raised from ICOs, as of August, than from earliest-stage venture capital, according to a recent Goldman Sachs report. The amount raised in ICOs this year reached $1.5 billion in September.”

This trend is both new and persistent. It is driven by the intersection of several factors including:

- Blockchain architectures.

- Increasing worldwide consumer sophistication.

- Pervasive always-on unlimited-computing resources.

- Increasing consumer dissatisfaction with available alternatives.

From the investor’s perspective:

- Blockchains are hot*.

- New offerings appear daily worldwide.

- Smaller investments are not just ok, they’re encouraged.

- The public nature of the codebase and culture can help with due diligence*.

- ROI time horizons are greatly shortened* relative to traditional venture capital.

From the entrepreneur’s perspective:

- Blockchains are hot*.

- It’s relatively easy to raise capital from your early customers vs. investors.

- Raising money from prospective customers solves a whole host of other problems.

- It’s attractive to trade tokens/coins, which have no intrinsic value, rather than equity for capital.

* Caveats always apply. Buyer beware. Scams are legion. Execution is the true measure of success. Failure’s fathers are plentiful and many of them are honorable.

In some ways, it would be correct to say that these blockchain capital waves are intended to change society’s methods for value comparison, tracking and storage, which are all monopolies nation-states have guarded jealously to themselves for millennia.

Thanks to Satoshi Nakamoto et al., it has recently become conceivable to change the nature of ledgering itself, one of the oldest of our activities as a people. Among the most ancient forms of writing are cuneiform ledgers keeping track of, “His stuff, my stuff, the king’s stuff,” which collectively could be called, “Private records of the store of value.” Today, high-fidelity always-on databases are direct descendants of those cuneiform ledgers (tracking my stuff, his stuff, Visa’s records of our stuff). And they are everywhere, deeply embedded in modern society.

Blockchain architectures are making it possible (and soon, practical) for anyone to independently measure, capture and pass forward stored value. One could even say that blockchain software has begun refactoring segments of human societies.

It is too early to predict all the transformations which will arise from distributed immutable ledgering technologies. It is not too early to know that the changes will be massive in dollar terms. They will be much bigger than the .com “revolution” was.

It’s an exciting time to be in the startup world. The waves are delicious, and the sets just keep on coming. There are sharks and shoals, the rich and the brave keep on surfing while the crowd,“oohs,” and “aaahs,” and the governments of the world march up and down the beach displaying their various carrots and sticks. Stay tuned.

For more information on business investment, visit our blog dedicated to small business entrepreneurs. Chompff Consulting is a team of experts teaching entrepreneurs how to build minimum viable businesses, bring products and services to market and then seek professional investment.

Waves of Capital are Going into Blockchain Startups by Alex Chompff is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.